As technology, transportation and other factors have progressed and become more widely accessible, the world has become significantly more globalized. This increased globalization has, of course, led to easier and increased trade of many commodities between the

nations, and the trade of base oils is certainly no exception.

But how exactly have base oil trading trends changed during the past few decades, and what factors have forced these changes to occur? David Whitby, chief executive of United Kingdom-based Pathmaster Marketing Ltd., answers these questions and more.

Lubes’n’Greases: It would seem that before one could understand how base oil trade has shifted in the past several years, it would be vital to first understand how production capacity in the world’s various regions has evolved. So how has base oil production capacity shifted since the 1990s? What are some of the main reasons for this shift?

Whitby: Since 1993, the global number of base oil manufacturing plants has declined from 166 to 147. At the same time, the combined capacity of these plants has increased from 47.13 million metric tons per year to 60.26 million metric tons per year. This is because a number of older, smaller and/or less economically efficient plants have been closed, while a number of much larger new plants have been built. The biggest changes in the number of plants have occurred in Asia (up from 37 to 61), North America (down from 32 to 18), Western Europe (down from 29 to 17) and the Middle East (up from 7 to 15).

Lubes’n’Greases: Similarly, it seems as if the type of companies producing base oils would likely have the potential to affect the trade of their products in one way or another. Has the type of company producing base oils (i.e. major oil companies, state-run businesses and independent oil companies) shifted in the past 30 years? If so, what factors have prompted that shift?

Whitby: During this period, a significant number of state oil companies have been privatized, leading to a growing number of independent and non-oil major manufacturers of base oils. The exceptions are the state oil companies in China and Russia, which have built a number of new base oil manufacturing plants. For example, the manufacturing capacities of the Chinese base oil producers has increased from 4.27 million metric tons per year in 2005 to 7.41 million metric tons per year in 2022. The oil majors—notably Shell, ExxonMobil and Chevron—have maintained a presence in manufacturing base oils, while BP and Total have exited this business. Globally, the manufacturing capacities of independent base oil producers have increased from 14.21 million metric tons per year in 1993 to 35.59 million metric tons per year in 2022.

These changes have occurred mainly as a result of the privatizations of former state oil companies, particularly in Asia, South America and Central Europe, as well as the growth of the market for base oils and lubricants in Asia. Shell, ExxonMobil and Total continue to manufacture base oils because this is important for their manufacturing and marketing of finished lubricants.

Lubes’n’Greases: What do regional and global base oil trading patterns look like right now? How do they differ now from years previous?

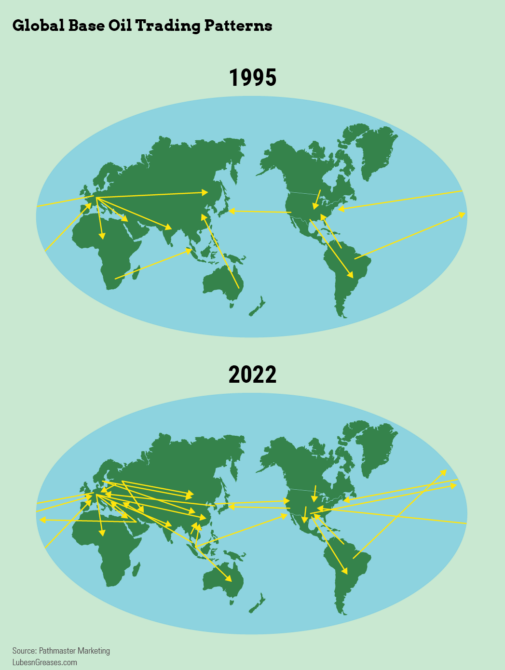

Whitby: Global trading patterns for base oils have changed significantly from 1995, when Western Europe was a major exporter of base oils to all other regions. Now, base oils are widely traded—both within regions and between them. As a result, buyers of base oils are now able to obtain them from several potential suppliers, either within their region or from a different region. Freight rates and ship availability have become additional factors in the costs of procuring base oils, too.

Main Base Oil Exporting Countries, 2022

Main Base Oil Importing Countries, 2022

Lubes’n’Greases: It is clear that the types of base oils used in various lubricant applications has changed over the past several years. For instance, Group III base oils have become very popular in regions like the United States and Europe for automotive applications. Is one type of base oil (Group I, II, III, etc.) more highly traded than the others? Does this depend on the region? Are synthetic base oils increasing in popularity around the world, or just in certain regions?

Whitby: No single type of base oil is more widely traded than the others. Group I base oils continue to be exported from Western Europe, while Group III base oils are exported from the Middle East and South Korea. Group II base oils are exported from the United States, Canada, Singapore and South Korea. Africa and Central and South America are significant importers of all types of base oils. All types of base oils are traded within each region.

Synthetic base oils—such as polyalphaolefins, esters and polyalkylene glycols—are being used increasingly in all regions. Western Europe started this trend in the automotive lubricants market in the 1990s, and North America, Japan and Australia began to follow suit about twenty years ago. Asia, Central and Eastern Europe, the Middle East, and Central and South America have begun to catch up now. Use of synthetic base oils in Africa has only started recently. In recent years, more marketers of lubricants based in Group III base oils have been describing them as having “synthetic performance.”

It is also worth noting that the world’s major manufacturers of lubricant additives are based in either Western Europe, North America or Singapore, so these regions are the major exporters of these materials to the rest of the world.

Lubes’n’Greases: Of course, biobased base stocks are increasingly becoming a topic of conversation in the lubricants industry as companies are placing a greater emphasis on their sustainability efforts, but biobased base stocks are still quite the niche product. Why are base oils made from plant materials more scarce and seldom traded than their mineral oil counterparts? Might this situation change in the coming years?

Whitby: Base oils manufactured from plant materials are a small proportion of the global base oils business because there are insufficient sources of raw materials. Unless biobased materials are manufactured from waste agricultural materials, they need to compete with foodstuffs for raw materials. Although more attention is being paid to the use of waste agricultural materials as feedstocks for biobased lubricants, a growing global human population is likely to put greater pressure on the supply of foodstuffs and the land upon which to grow them.

Lubes’n’Greases: The base oil and lubricants industry has never been static and likely never will be because it must evolve to keep up or even get ahead of new technology. Similarly, it seems like the trade of base oils would also need to evolve to keep up with changes in the world economy, etc. Based on current patterns, how might base oil trading patterns evolve in the coming years?

Whitby: The current patterns of base oil trading are unlikely to change much over the next few years, except for the export of base oils from Russia. Base oils are likely to continue to be traded widely, both within and between regions. This is because the properties and performances of each of the main types of base oils are well understood, so having several potential suppliers has proven to be advantageous for buyers’ supply chain flexibility and stability.

Lubes’n’Greases: Trading patterns are more often than not affected by geopolitical events, such as wars and elections of political leaders. How might geopolitical events—such as the COVID-19 pandemic or Russia’s invasion of Ukraine—affect these patterns for base oils in particular?

Whitby: As a consequence of Russia’s invasion of Ukraine and the sanctions applied by Western Europe, the United States, Japan, Australia and Canada, Russia is now unable to export base oils to the countries that have applied sanctions. Russia used to export around one million metric tons of base oils to Western and Central Europe each year. Russia is now desperately seeking alternative markets in Asia, Africa and South America, but it will face much higher transportation costs now. As a consequence, it will have to incur significant discounts to base oil prices in order to compete with more local suppliers in and to these regions. This could continue for several years, if not permanently.

Other geopolitical events could disrupt base oil trading patterns in the future.

Sydney Moore is managing editor of Lubes’n’Greases magazine. Contact her at Sydney@LubesnGreases.com