Market players were in discussions regarding orders for the upcoming weeks, with suppliers focusing on moving barrels so as to avoid finishing the year with hefty inventories, and consumers being very conservative in terms of cargo size.

While there has not been any allusion to posted price decreases, sources said that suppliers continued to grant discounts and temporary competitive allowances – TCAs – to stimulate sales. It is very quiet, with price pressure to move volume, a source acknowledged.

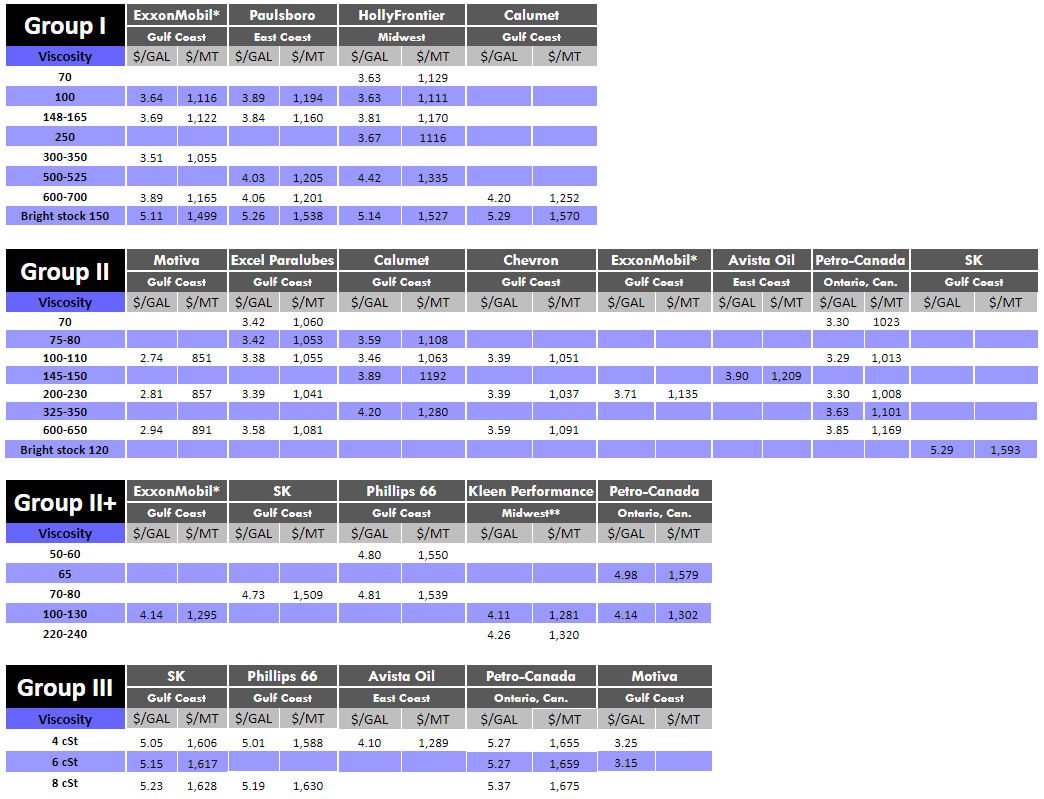

The steepest discounts were reported within the export market, especially for those producers who are facing a challenge with their spot inventory. According to sources, spot export prices for some API Group II grades have fallen under $2 per gallon.

A recent tender held by a United States Gulf Coast producer was heard to have been possibly concluded for shipment to India in the high $1.70s/gal for light grades, but the information could not be confirmed. However, this number was not seen as representative of the export market as a whole, because prices in India are typically much lower than in other regions due to strong competition between Northeast Asia and Middle East suppliers, who are currently the main players there.

Mexican base oil consumers had shown a healthy appetite for U.S. base oils until recent weeks, but many have now taken a wait-and-see position in hopes that prices soften. They are likely to jump at opportunities to secure material before the end of the year, sources said.

U.S. Group II cargoes have also been offered into Europe, although suppliers are facing strong competition from Asian material and heavily discounted Group III grades, with everyone seemingly vying for sales into a market that is already rather well-supplied.

As mentioned last week, the domestic Group I segment (and Group II segment to a certain extent) may experience some tightening as a couple of producers embark on turnarounds this month and in December.

Calumet started the first part of a turnaround schedule at its Group I and II plant in Shreveport, Louisiana, last weekend. This portion of the shutdown will only affect its mid to heavy-vis cuts (325, 600, 2500 vis) and will be completed near the end of the month. The second part of the turnaround will impact the companys light-vis cuts (60, 80, 100, 150 vis) and will take place from Dec. 1 until Dec. 15.

HollyFrontier has also planned a turnaround at its Group I unit in Tulsa, Oklahoma, starting at the end of October, according to a company source.

Additionally, Paulsboro was heard to be running its Group I facilities in New Jersey at reduced rates.

In terms of finished lubricants, demand was described as steady, with no unusual factors swaying business in one particular direction, except for the General Motors strike (more on this below), which has affected the automakers parts and lube suppliers. Manufacturing activity tends to slow down in the last three months of the year, and sellers were monitoring inventories quite carefully.

Fairly stable crude oil prices over a few days provided a bit of a respite to producers, whose margins were said to have been squeezed since mid-year due to the climb in oil values against the relatively steady-to-soft base oil pricing.

Crude oil futures strengthened on Tuesday, however, following a downward streak that lasted several days, after signs of progress in trade talks between the U.S. and China, and reports of record exports of U.S. crude oil. The gains were capped by bearish global economic performance – which could lead to lower crude demand – and a buildup in U.S. crude stockpiles.

On Tuesday, Oct. 22, West Texas Intermediate November futures settled at $54.16 per barrel on the CME/Nymex, and had closed at $52.81/bbl on Oct. 15.

Brent futures for December delivery were reported at $59.70/bbl on the CME on Oct. 22, and had closed at $58.74/bbl on Oct. 15.

Light Louisiana Sweet crude wholesale spot prices settled at $56.03/bbl on Oct. 21 and had closed at $56.92 on Oct. 14, according to the Energy Information Administration.

(Low sulfur vacuum gas oil and high sulfur VGO prices for Oct. 21 were not available from OPIS PetroChemWire at the time of writing.)

In automotive-related news, as the workers strike at General Motors (GM) enters its fifth week, a tentative agreement was reached last week between the company and negotiators for the United Auto Workers union, CNN.com reported.

The negotiating team and union leadership are both recommending that the nearly 50,000 strikers vote to ratify the new four-year agreement, with the results of the vote expected to be released Friday evening.

The tentative deal would pay members an $11,000 signing bonus and raise hourly pay for veteran workers 6 percent over the life of the contract, to $32.32. It would also allow many temporary workers to become permanent employees, and GM agreed to drop its demand that workers pay a much greater percentage of their own health care costs.

However, the UAW was not successful in its efforts to have GM shutter some of its production in Mexico and relocate it to the U.S. to revive doomed plants there. GM agreed to save the Hamtramck assembly plant in Detroit, but the union was unable to save three other plants – an assembly plant in Lordstown, Ohio, and transmission plants in Warren, Michigan, and Baltimore, Maryland, all which halted production earlier this year, the CNN.com article explained.

Lubes’n’Greases Publications shall not be liable for commercial decisions based on the contents of this report.

Historic U.S. posted base oil prices and WTI and Brent crude spot prices are available for purchase in Excel format.