Some segments of the base oil market seem to be slightly longer than others in terms of supply, while demand was characterized as lukewarm for most grades, likely affected by economic uncertainties and unpredictable crude oil prices.

Supply and demand appeared balanced for API Group I grades, partly because of steady requirements, and partly because of reduced operating rates and plant turnarounds, sources said.

According to reports, Paulsboro has been running its Group I facilities in New Jersey at reduced rates, while Calumet has scheduled a two-part turnaround at its Group I and II plant in Shreveport, Louisiana.

Calumet will complete a turnaround affecting its mid to heavy vis cuts (325, 600, 2500 vis), starting at the end of this week and finishing near the end of the month. The second part of the turnaround will affect the companys light vis cuts (60, 80, 100, 150 vis) and last two weeks, starting on Dec. 1, a company source explained.

HollyFrontier has also scheduled a maintenance shutdown at its Group I unit in Tulsa, Oklahoma, starting at the end of October, according to a company source.

The situation appeared somewhat different for Group II base oils, as availability was described as more than adequate. Suppliers have granted discounts into some large accounts so as to encourage orders, while a Group II producer was reported to have offered a sales tender for a 10,000 metric ton cargo, which may end up moving to India, sources speculated. Base oil prices in India have been depressed due to abundant availability of South Korean and Middle Eastern barrels.

Another export destination that had so far been taking a healthy stream of United States exports was Mexico, but that market has slowed down as well, as base stocks from other sources such as Asia and the Middle East have been offered at attractive prices. Production by the local Mexican producer, Pemex, was heard to be down, and this may eventually ensue in additional requirements once existing inventories are depleted.

In the Group III segment, product was reported as ample, with prices said to be under pressure. A majority of U.S. requirements continue to be met by South Korean and Middle East imports, with suppliers focusing on maintaining market share.

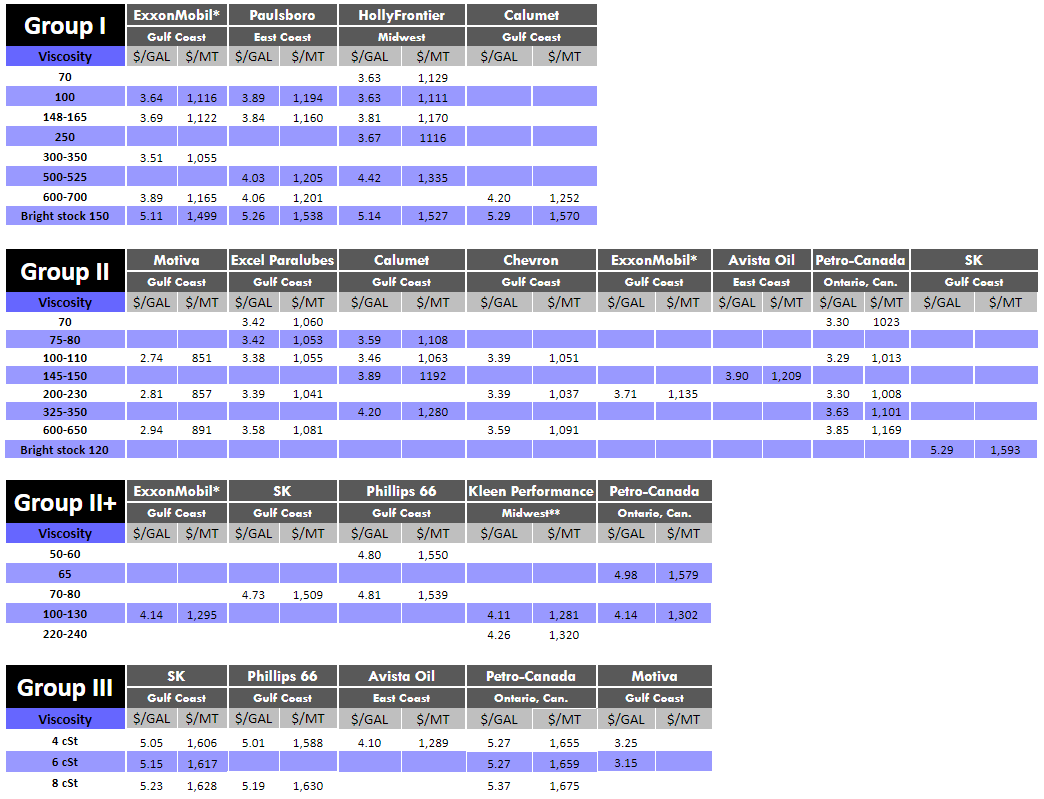

While there have not been any general price adjustments initiated by producers, discounts and temporary competitive allowances are being offered for contract volumes in all segments as prices are soft throughout the market, sources said.

The controversy continues on whether the implementation of the International Maritime Organizations 2020 regulations on Jan. 1 would have a significant impact on base oils, with some players expecting supply to tighten as a result of refiners streaming feedstocks into low-sulfur marine fuel production, and others anticipating a limited impact on base oils.

It seems to me that in the past when spec changes have been imposed (such as reducing sulfur levels in fuels, or lead in gasoline, or introducing ethanol in gasoline) – for environmental reasons or whatever – the industry adapts and life goes on with hardly a ripple. Im not saying that Im sure this will be the case, but maybe this will just be another Y2K! a source commented. So far, the impact has not been obvious, but it may be gradual and more reverberations may become evident as the year comes to a close, another source added.

Upstream, crude oil futures initially fell on Tuesday, perpetuating a trend from earlier in the week, but bounced back in late trading on sudden buying interest. Prices remained weighed down by weak economic data for China and ongoing concerns about the U.S.-China trade dispute, as there appeared to be no resolution in sight.

On Tuesday, Oct. 15, West Texas Intermediate November futures settled at $52.81 per barrel on the CME/Nymex, and had closed at $52.63/bbl on Oct. 8.

Brent futures for December delivery were reported at $58.74/bbl on the CME on Oct. 15, and had closed at $58.24/bbl on Oct. 8.

Light Louisiana Sweet crude wholesale spot prices settled at $56.92/bbl on Oct. 14 and had closed at $55.66 on Oct. 7, according to the Energy Information Administration.

Low sulfur vacuum gas oil and high sulfur VGO were both at Nov. WTI plus $15/bbl ($68.59/bbl) on Oct. 14. By comparison, low sulfur VGO was hovering at $67.75/bbl and high sulfur VGO at $67.50/bbl on Oct. 7, according to data published by OPIS PetroChemWire.

In automotive-related news, there was hope that an agreement might be reached between the United Auto Workers union and General Motors, even as the workers strike continues at GM plants around the U.S., various media outlets reported. The UAW has called its national council to a meeting in Detroit on Thursday. This is the first time since the strike started almost one month ago that the council has been called to a meeting in Detroit, and was seen as a positive sign as negotiations between the UAW and GM continue. The strike has affected and brought losses to all segments linked to the automakers operations, including lubricant and additive suppliers, sources commented.

Lubes’n’Greases Publications shall not be liable for commercial decisions based on the contents of this report.

Historic U.S. posted base oil prices and WTI and Brent crude spot prices are available for purchase in Excel format.