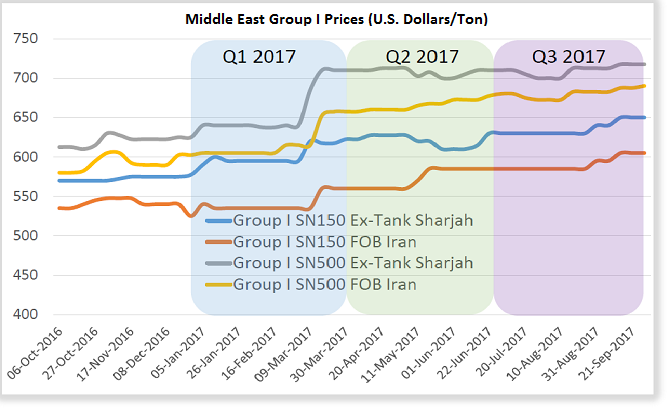

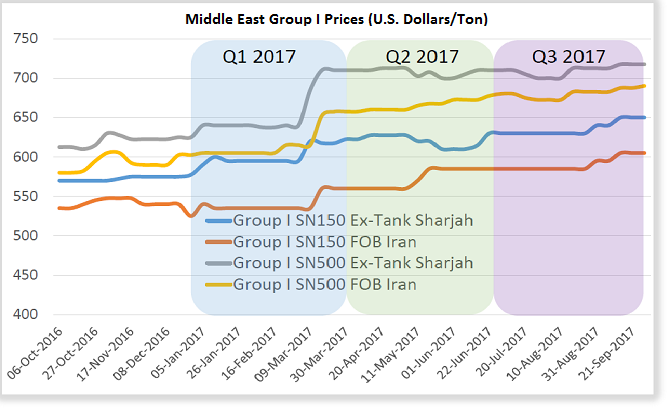

Prices for API Group I base oils from the Middle East have proved surprisingly resilient despite U.S. President Donald Trumps recent decertification of the Iran nuclear deal. With an installed blending capacity of over 1.2 million tons, Iran dominates the regions Group I spot market according to Izham Ahmad, markets editor at ICIS.

Lingering uncertainty over the international communitys future policy with the Islamic Republic has hampered its efforts to rejoin international base oil markets. Irans markets remain restricted, and many issues remain. 2017 started with some optimism over the easing of financial sanctions and prices remain relatively firm, Ahmad told delegates at the Middle Eastern Base Oils and Lubricants conference in October.

The buoyancy in Group I prices is due to healthy demand from the Middle East and Africa, as well as some supply tightness. In spite of a global shift away from Group I, base oils prices ticked up at the end of the first and second quarters and have remained stable since then.

Group II base oil prices have been driven by supply and demand fundamentals in Asia and other markets, yet new Group II capacity from the Middle East could alter the balance, Ahmad said. Group III base oil production from Gulf refiners is mostly exported, but market sources have highlighted some Group III cargoes of Middle East origin in the United Arab Emirates, Ahmad said.

Meanwhile, Africa has grown in importance for Middle East refiners, but serious challenges – notably poor infrastructure and lack of access to foreign exchange – dampen the outlook for the continent. Still, Iranian blenders remain a major supplier of finished lubricants to Africa, one of its few consistent export markets during sanctions, together with China, India, the Middle East and Turkey. Irans ability to accommodate increasing demand for higher quality products hinges partially on foreign direct investment and access to technology.

Nonetheless, the Middle East is now seen as a base oils hub with Bahrain, Qatar, Saudi Arabia and the U.A.E. contributing to the global supply chain despite worldwide lubricant demand being flat, estimated at 38.5 million tons in 2016. In the near future it is going to stay that way, returning a compounded annual growth rate of less than 1 percent until 2021, according to ICIS.

With sluggish demand, competition between Asia and the Middle East will intensify as the two base oil producing regions vie for market share, leading to a realignment of global base oil trade flows. Middle East refiners will have a greater role in global base oil markets next year, particularly in Asia given their geographical and logistical advantage, the New Jersey-based consultancy predicts. Price spreads of Middle East and Asia Group III base oils have fluctuated between $50 and $100 per ton in recent months, but ICIS expects the spread to narrow as competition grows.

The increased presence of Middle East origin base oils may also limit arbitrage opportunities for U.S. suppliers in Asia, forcing U.S. Group II suppliers to increase sales in the Americas and elsewhere. Expectations of additional base oil supply from the Middle East will also quicken the regional supply-led transition from Group I base oils, which has been happening at a faster rate in other markets.

Though the Middle East is a small market – representing around 5 percent of global base oil demand – it is one of the fastest growing after Asia. The onset of mandatory specifications, including the Gulf-wide implementation of API CH-4 as a minimum standard, will likely propel demand for higher quality base stocks even further.

Source: ICIS