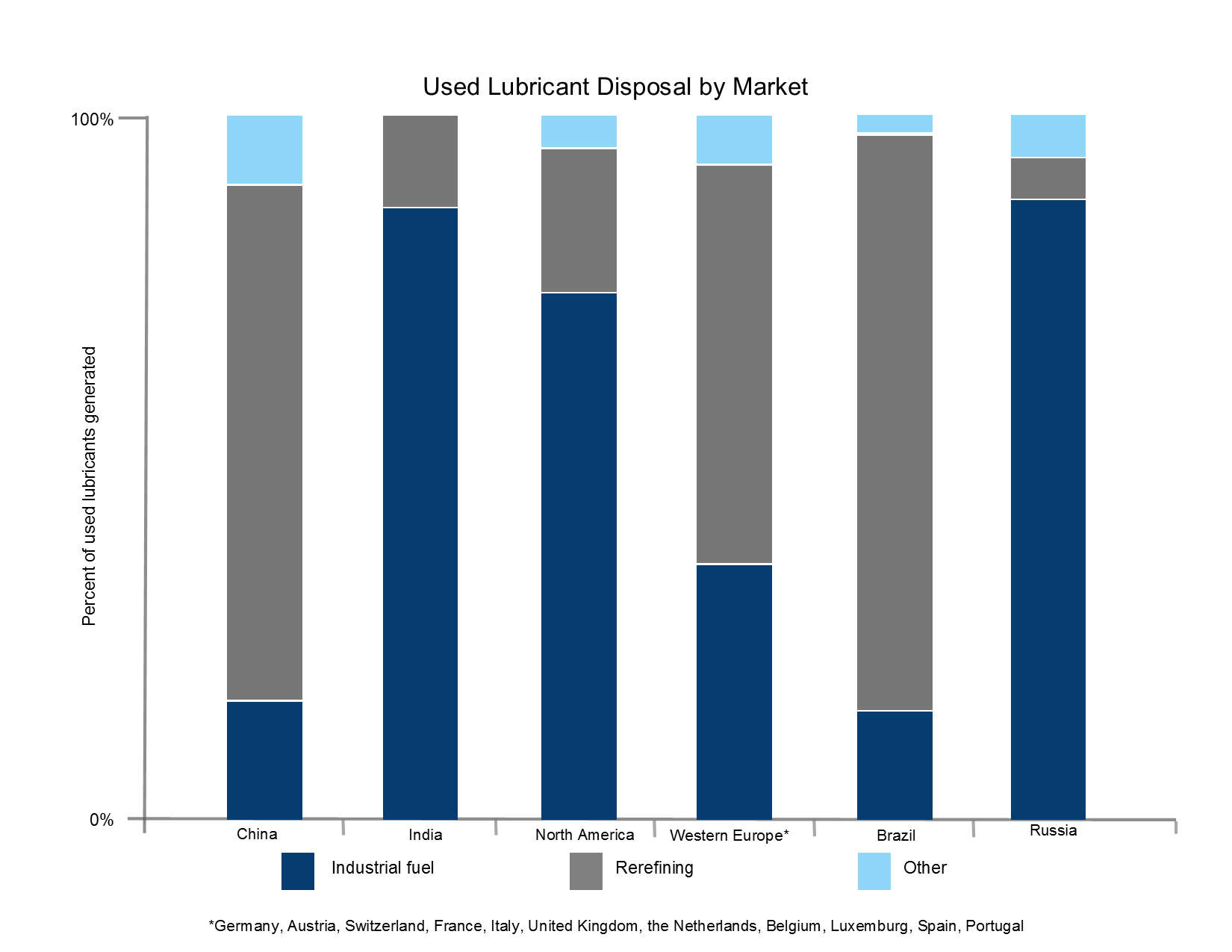

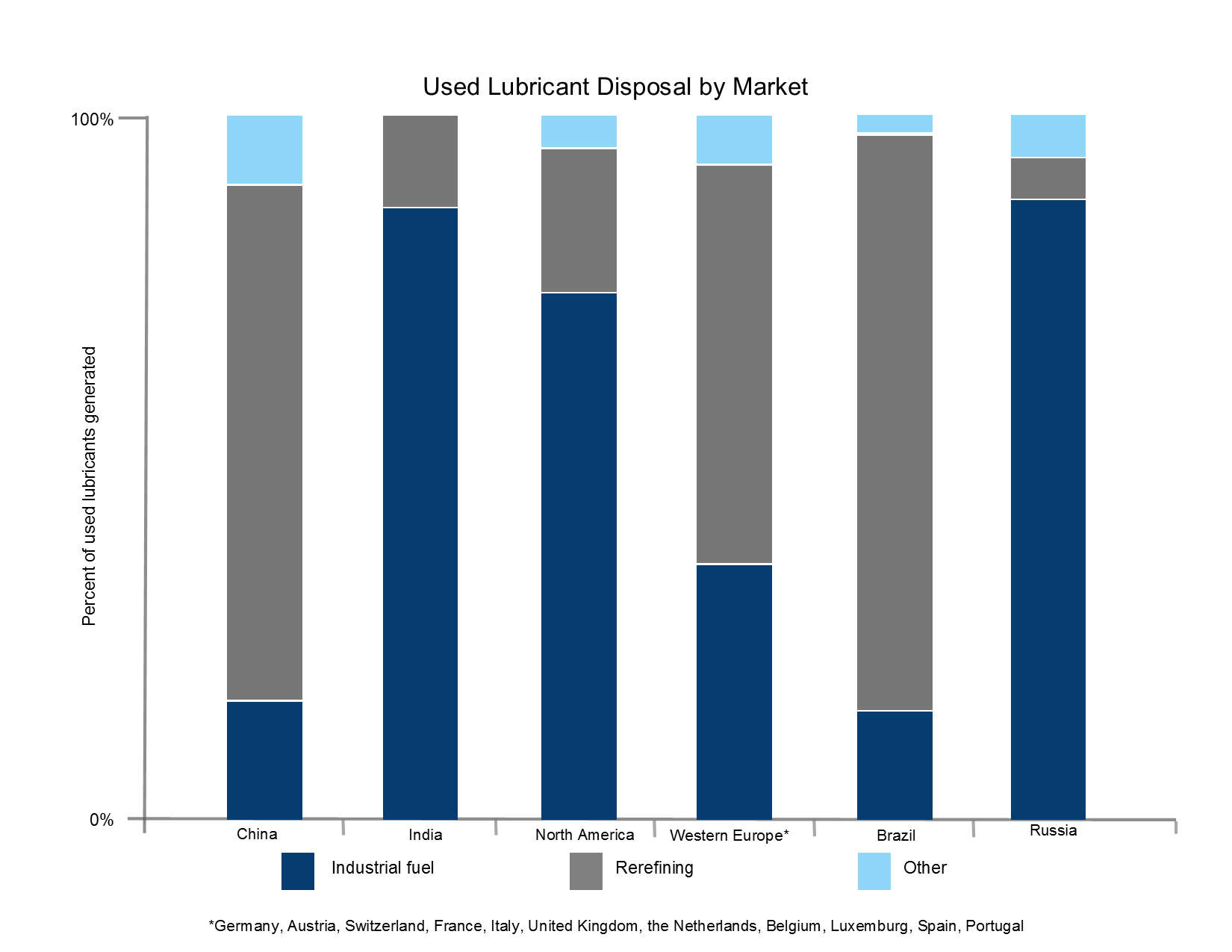

China and India are the second- and third-largest lubricant markets, but they handle their used oil differently, according to a report from Kline & Co. India burns most of what it collects as industrial fuel, while China focuses more on rerefining to produce base stocks.

In addition to India and China, the study covers North America, Western Europe, Russia and Brazil. Together, these regions consumed 24.6 million tons of lubricants in 2015, or 63 percent of the global total, reported Kunal Mahajan, project manager for energy at the Parsippany, New Jersey-based consultancy. Five of the markets together generated 13 million tons of used oil; no estimates were given for Russia. China followed North America in used oil volume, trailed by Western Europe, India, Russia and Brazil.

To harvest that used oil, many licensed collectors operate in China alongside rerefiners. There, a disposal fee must be paid, as used oil is considered a hazardous waste. Klines figures show that most used oil collected in the country is then rerefined.

In India, on the other hand, the majority of used oil is burned as industrial fuel. Reasons range from a lack of adequate rerefining capacity to poor regulatory enforcement. A busy market for low-priced kerosene – used oil mixed with kerosene and sold as fuel oil – makes this approach more profitable than rerefining waste oil into base stocks, explained Mahajan.

According to Kline, rerefiners typically use one of four business models. Most businesses follow the rerefining and base stock sales model, which provides a fairly simple entry into the market. In-house blending and private label sales is also easy for rerefiners toll-blending for major rerefined lubricant brands.

The other two models are more difficult to execute, Mahajan observed. In-house blenders selling under their own branded label – like Mangalam Lubricants in India – must compete with the majors. The closed loop model, in which companies collect used oil to rerefine it and then sell finished product back to the generator – only exists in North America and Western Europe. Other markets dont use this model because of limited consumer acceptance of rerefined products and the absence of large-scale operations required for this approach. Further, Mahajan warned, there is a trust issue due to illegal activities of selling used oil as fresh lubricants or selling used oil as fuel in some markets.

Graph: Kline & Co.

In developing markets like China and India, where demand for API Group II base stocks is less than in developed markets, rerefiners have kept their focus on producing Group I oils. They mostly sell to small blenders that are price-sensitive and have little brand power. Difficulty procuring feedstock is a frequent challenge.

Kline expects more used oil to be collected in all studied markets through 2025. Improving infrastructure and greater consumer awareness of the harmful environmental effects of used oil will help drive such growth in developing markets.

In China and other countries, rerefining will improve as collection capacity increases, said Mahajan. On the other hand, rerefining is expected to decline in India. This is because we do not expect the subsidy on the kerosene oil to be reduced or taken away, and the practice of mixing used oil with kerosene oil and using it as light diesel oil is expected to increase, he explained. The resulting strain on available feedstock may lead to the demise of some rerefiners in the country.

The presentation, titled Global Used Oil and Rerefined Lubricants: Market Analysis and Opportunities, was published during the second quarter of this year.